Introduction

The State of Wisconsin Investment Board, or SWIB, is celebrating its 70th anniversary this year. This alliance of policymakers and union officials works together to ensure a bright financial future for trust fund beneficiaries.

SWIB is responsible for running the Wisconsin Retirement System (WRS), the State Investment fund and a few smaller funds based in Wisconsin.

Here’s a look at how SWIB was formed and its private equity program.

History of SWIB

Prior to SWIB’s founding, money collected by the state didn’t earn interest, according to SWIB. Senate Bill 560, passed in 1951, allowed the state to invest the surplus of funds, and in the same year, SWIB began investing in the stock market.

In 1965, SWIB became the first pension fund to include a private placements investment program in 1965. Thirty years later, SWIB created the International Investment Program so that it could find opportunities in foreign markets.

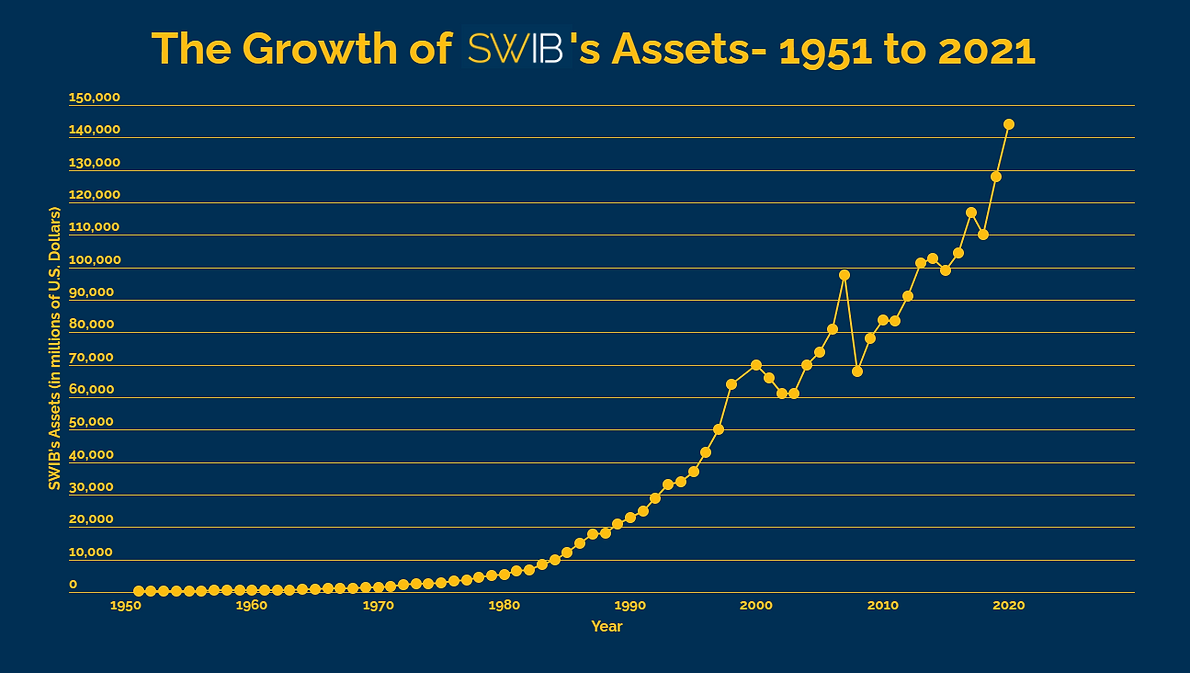

SWIB also began managing the Wisconsin Retirement System (WRS) in 1975. According to SWIB’s LinkedIn page, the WRS is the 8th largest pension plan in the United States. SWIB is now managing around $144 billion in assets and a variety of other diverse investments.

Wisconsin’s Private Equity Program

The Wisconsin Private Equity Program was created to support Wisconsin- and Midwest- based venture capital firms. As a branch of SWIB, the program is committed to funding six venture capital firms, four of which are based in Wisconsin.

SWIB’s first initiative was a proposal to invest $50 million in non-public healthcare and biotech companies in Wisconsin and the Midwest, and the board approved the proposal in 1999. According to SWIB, $45 million of the funds went to Mason Wells Biomedical Fund I in Milwaukee and Venture Investors Early Stage Fund III in Madison.

Their second initiative allocated up to $100 million in venture capital funds, $90 million of which was $90 million was given to Baird Venture Partners Fund I (B) and Frazier Technology Ventures II. Today, Seattle-based Frazier Technology Ventures II has approximately $217 million in assets.

In 2008, SWIB invested $25 million in Baird Venture Partners Fund III, plus $15 million for co-investments in Wisconsin portfolio companies. In 2011, SWIB committed $80 million to Northgate Capital, which has offices in California and Mexico.

When 2012 came around, SWIB committed $25 million to Early State Fund V, and two years later it committed $25 million to Baird Venture Fund IV and $15 million to 4490 Ventures. The Madison-based 4490 Ventures has Wisconsin startups such as EatStreet, Abodo (now Rentable) and HealthBridge in its portfolio.